Dye Autos Denver Area Truck and Automotive Blog

Many consumers believe you can’t finance a used pickup truck or car. The fact is, used car dealers have some of the best financing available. They work with credit unions and banks to get the most attractive terms and pass them onto you. Like all loans, making a down payment is advantageous. But how much should you actually put down on a pickup truck?

Many consumers believe you can’t finance a used pickup truck or car. The fact is, used car dealers have some of the best financing available. They work with credit unions and banks to get the most attractive terms and pass them onto you. Like all loans, making a down payment is advantageous. But how much should you actually put down on a pickup truck?

A down payment isn’t always required for purchase, but it’s definitely a good idea.

Why?

- It will reduce the amount you’ll need to borrow.

- It improves your chances of loan approval.

- You may get better terms with a down payment.

- It will reduce your monthly payment.

First, let’s define down payment.

The phrase is actually derived from the old practice of putting money down on the table to show a seller good faith when negotiating a deal. Today, the down payment is simply a way of reducing the amount of risk a lender has to take when helping you make a substantial purchase.

Down payment isn’t always cash.

Your trade-in vehicle can serve as a down payment. If you still owe on that loan, the amount of “equity” you have can serve as your down payment. “Equity” is the difference between your trade-in’s loan payoff amount and the actual cash value of your car.

If you have a trade-in, and if you can swing it, any additional down payment – even a few hundred dollars – has a very positive effect in the long term.

For more pickup financing tips, check out our post: “Answers to Your 6 Biggest Used Car Financing Questions”

To determine the amount your down payment should be on a pickup truck, consider these two important factors.

1. Credit Score.

Before attempting to finance any purchase, you should always know your credit score.

Check your credit report as soon as you start thinking about buying a used car or truck, even if it’s months in advance. If you’ve got less-than-ideal credit, taking this action will help you even more…and save you tons of time and money.

By cleaning up your credit before applying for a loan, you improve your chances of being approved with decent terms. Cleaning up your credit will include paying off past due accounts, disputing credit report errors, and adding positive information to your credit report.

ProTip: You can obtain a FREE credit report.

When you check your credit score, be sure to focus on where you fall in comparison to other consumers, and what areas of your credit are strong — and what might need some work.

FTC (Federal Trade Commission) Website: You’re entitled to one free copy of your credit report every 12 months from each of the three nationwide credit reporting companies. Order online from annualcreditreport.com, the only authorized website for free credit reports, or call 1-877-322-8228. You will need to provide your name, address, social security number, and date of birth to verify your identity.

2. Your Monthly budget.

The bigger your down payment the lower your monthly payment will be.

For a used pickup truck loan, you generally want to put down 10% or more of the vehicle’s sale price if you want to reduce your monthly payment. For example, if you want to finance the purchase of a $15,000 pickup, you should plan to put at least $1,500 down. Lenders may require more down payment depending on your creditworthiness.

Generally, for every $1,000 of down payment you apply, you can expect your monthly payment to drop by about $25 to $30, depending on the interest rate.

Depending on your credit score, current interest rates and the type of pickup truck you want to buy, you may not need a large down payment. Some people like to finance as much as possible and keep their cash for other things.

Where do I go to learn more?

Each vehicle sale is different but at Dye Autos, we’ve sold thousands of pickup trucks and we’ve helped a lot of people who thought they’d never be able to afford a vehicle.

Give us a chance to help you. Call us at (303) 286-1665 or use our handy online financing pre-approval form >>here<<.

Read MoreWhat Used Car Shoppers Need to Know About Credit Reports

Your credit report is one of the most important elements of your financial life. Whether you’re buying a home or car or qualifying for a new apartment, your credit report influences decisions. We sell a lot of used trucks and cars, and we’ve learned over the years that used car shoppers need to know about credit reports.

Your credit report is one of the most important elements of your financial life. Whether you’re buying a home or car or qualifying for a new apartment, your credit report influences decisions. We sell a lot of used trucks and cars, and we’ve learned over the years that used car shoppers need to know about credit reports.

Knowing what’s in your credit report saves time and money. You make better decisions and things go smoother when you’re at the dealership.

Here are some tidbits you should know.

You can obtain a free copy of your credit report.

FTC (Federal Trade Commission) Website: You’re entitled to one free copy of your credit report every 12 months from each of the three nationwide credit reporting companies. Order online from annualcreditreport.com, the only authorized website for free credit reports, or call 1-877-322-8228. You will need to provide your name, address, social security number, and date of birth to verify your identity.

Some states like Colorado have laws that allow you to get a free credit report in addition to the free annual credit report you’re entitled to by Federal law.

Always know your credit score.

If you plan on using financing to buy a used pickup truck, your credit score is key to getting the lowest interest rates. Your credit score is a three-digit number that uses your credit information to assess how risky a borrower you are, and it can significantly influence how lenders decide the terms of your loan.

The higher your credit score, the lower your risk and the lower your interest rate. The lower your credit score, the riskier you are and the higher your interest rates. Be proactive in checking your credit score beforehand so you know where your credit stands before you apply for a loan.

Take advantage of Fair Isaac’s free credit education.

Put some time into understanding how credit works and how your credit scores will be impacted by your actions—late payments, opening a new line of credit, etc.

Fair Isaac Tools—creators of the FICO credit score—have several tools that can help you understand credit scores, including a free credit score estimator and a loan savings calculator.

All the “Credit Basics” are located at myfico.com

Understand all the ways you can boost your credit.

Here are the ways to bring up your credit score:

- Make sure your open accounts are in good standing.

- Pay all your bills on time – even those that aren’t’ on your report.

- Keep accounts out of collections.

- Reduce your balances and keep them low.

- Make sure your credit limits are reported correctly.

- Leave old accounts open and keep them active.

- Open new accounts sparingly.

- Have different types of accounts.

- Clean up any negative items.

Used car shoppers need to know about credit reports.

Because so many businesses use your credit report to make decisions about you, it’s important that you check your credit report at least once a year to be sure the information in your credit report is accurate.

Need help with choosing your dream pickup truck or car that fits your budget? Dye Autos can help. Get in touch through our site >>here<< or give us a call at (303) 286-1665!

Read More

You’re ready to get rid of your current car and get yourself a new one. For many vehicle owners, there’s nothing easier than trading in a car to a local Denver dealer. That way, you avoid the time and effort it takes to list, find a buyer and sell your vehicle online; plus, dealers today are working to make the trade process fast, easy and transparent.

Before you visit the dealer, be sure to take these important steps:

- Use online tools to appraise your car’s value. Edmunds.com and kbb.com are two great resources to appraise your trade-in’s value.

- Be honest with yourself about your car’s trade-in condition. The more forthright you are when using online appraisal tools, the better off you’ll be when it comes time to trade it in. Very often, people come into the dealership with an overly-optimistic idea of what their car is worth, only to find that reality is less optimistic.

- Give your trade-in curb appeal.

- Clean the exterior and interior well.

- Remove small dents.

- Fix window glass defects.

- Bring all vehicle paperwork with you. You will need:

- Certificate of title (if you don’t have it, the DMV can tell you how to get it replaced). Note: if you have an outstanding loan on the vehicle, this will not apply since the bank has your certificate of title.

- Current registration.

- All your car keys and the owner’s manual.

- If you still have a loan on the car, you’ll need to have your account number or a payment stub.

- Maintenance records. These help support your claims about whatever prior damage your car has had and the repairs it has undergone.

When you arrive at the dealership

Inform your salesperson that you will be trading in a car. The salesperson will likely take down some of your information, then either the salesperson or a manager will perform a visual inspection of your vehicle, record the vehicle identification number and run the number through a vehicle history database to check its records.

The salesperson or manager may take your car for a quick drive to see how it runs.

Getting your trade-in offer

The trade-in offer you receive will depend on several factors, but mostly it will rely on the price being sought for similar vehicles at auction. Other possible factors include whether or not the dealer has similar cars on the lot already, the condition of your vehicle and whether the dealership needs to make any repairs to make your trade-in ready for other buyers.

Since you’re trading in your car in order to buy another one, negotiating the price for your trade-in will include the car you’re buying.

Paying off your trade-in’s loan & finishing up your deal

When you’re trading in a car, there may be a little more wiggle room on your trade-in value against the price of the car you’re hoping to buy.

When the amount you owe on the car is less than the trade-in value, the process is pretty straightforward. Say you still owe $5,000 on your car and a dealer offers you $6,000 for it as a trade-in. The dealer pays off the $5,000 loan for you and then you transfer ownership of the car to the dealer. You can use the difference (in this example it’s $1,000) as a down payment on the car you’re buying.

When the amount you own on the car is more than the trade-in value, the dealer still pays off your loan. This leaves a balance due to the dealer which you can either pay cash for, or sometimes, roll that amount into the new loan you’re getting on the new car. Various factors like creditworthiness, terms and payment amounts govern which options you’ll take.

Dye Autos helps people like you trade-in their cars and trucks everyday! Give us a call at (303) 286-1665 or contact us >>here<<. We’ll help you navigate the process of trading in a car and get you into the car of your dreams.

Read More3 Steps to Prepare Your Credit to Buy a Used Pickup Truck

If you’re looking to buy a used pickup truck, you’ve undoubtedly done your research in advance about the right model and options. The key to affording your dream ride works the same way: Get your financial situation under control before you make your final purchase decision.

If you’re looking to buy a used pickup truck, you’ve undoubtedly done your research in advance about the right model and options. The key to affording your dream ride works the same way: Get your financial situation under control before you make your final purchase decision.

Here are three crucial steps to take that will help you become more informed about your credit and help you set realistic expectations before you get to the dealership.

1. Know your credit score.

If you plan on using financing to buy a used pickup truck, your credit score is key to getting the lowest interest rates. Your credit score is a three-digit number that uses your credit information to assess how risky a borrower you are, and it can significantly influence how lenders decide the terms of your loan.

The higher your credit score, the lower your risk and the lower your interest rate. The lower your credit score, the riskier you are and the higher your interest rates. Be proactive in checking your credit score beforehand so you know where your credit stands before you apply for a loan.

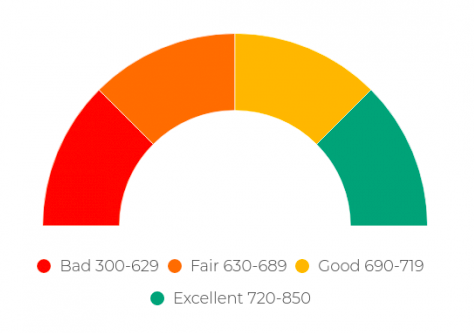

Credit score ranges:

2. Get a free credit report.

When you check your credit score, be sure to focus on where you fall in comparison to other consumers, and what areas of your credit are strong — and what might need some work.

FTC (Federal Trade Commission) Website: You’re entitled to one free copy of your credit report every 12 months from each of the three nationwide credit reporting companies. Order online from annualcreditreport.com, the only authorized website for free credit reports, or call 1-877-322-8228. You will need to provide your name, address, social security number, and date of birth to verify your identity.

3. Take steps to clear any blemishes on your credit.

Everybody wants the best deal possible when they’re ready to buy a used pickup truck. Banks base their financing offers on how well you’ve paid your debts so it’s crucial to clear any negative items off your credit report.

FACTS:

- One in five Americans are shocked to learn there are errors on their credit report.

- 79% of consumers who disputed credit report errors were successful in removing them.

If you have any blemishes on your credit report, take steps now to resolve them.

Example: If you’ve got a $48 collection on your report, make every attempt to make it right. If it’s a mistake, call the company and try to rectify it with them first. If that doesn’t produce results, dispute it with the credit reporting agencies. All three – Equifax, Experian and TransUnion – have simple forms on their sites for disputes.

If the $48 collection is not a mistake, make every attempt to remedy it, including paying it. You’ll save much more than the $48 in finance charges that lenders will be forced to charge you if you leave it on your report.

Pro Tip: Our finance manager at Dye Autos says, “90% of the collections we see are due to medical charges/fees. Call the company and try to negotiate down the amount you owe and set up a doable payment plan so that things will begin to look more positive.”

Wrapping it all up…

Are you ready to buy a used pickup truck but need help preparing your credit? We have over 70 years experience in the car and truck financing business and we can help you! Call Dye Autos at (303) 286-1665 or fill out our handy contact form >>here<<.

Read More Many car buyers prefer to trade in their current vehicle when getting another one because it’s easy. All you have to do is drive to the dealership, sign a your paperwork, and drive away in a different vehicle. What many buyers don’t know is that there are other benefits of trading in your car.

Many car buyers prefer to trade in their current vehicle when getting another one because it’s easy. All you have to do is drive to the dealership, sign a your paperwork, and drive away in a different vehicle. What many buyers don’t know is that there are other benefits of trading in your car.

One of the biggest benefits of trading in your car is that you can apply the trade-in credit to your down payment, thereby reducing the amount you need to finance. (ie: lowering your monthly payment!)

There can be tax advantages, too. Colorado and most other states require sales tax to be paid only on the difference between the price of your trade-in and the vehicle you’re buying, not the full price of the next car.

But this tax benefit doesn’t apply if you sell your old vehicle yourself!

Important tips when trading in your car

We’ve been selling trucks for a long time in the Denver/Wheat Ridge area. We’ve heard from customers like you who want to know “insider’s tips” on trading in your car. Here are four of our BEST tips!

- Give your trade-in curb appeal.

- Clean the exterior and interior well.

- Remove small dents.

- Fix window glass defects.

- Be honest with yourself about your car’s trade-in condition. The more forthright you are when using online appraisal tools, the better off you’ll be when it comes time to trade it in. Very often, people come into the dealership with an overly-optimistic idea of what their car is worth, only to find that reality is less optimistic.

- Don’t forget to pack all your car’s accessories. Trading in your car means you are trading in everything that goes along with it. Make sure the original owner’s manual and any extra keys are in the vehicle when you arrive at the dealership. Dealers like used cars that still have all the accessories and may even give you a better deal on your trade when everything is there.

- Bring all vehicle paperwork with you. You will need:

- Certificate of title (if you don’t have it, the DMV can tell you how to get it replaced). Note: if you have an outstanding loan on the vehicle, this will not apply since the bank has your certificate of title.

- Current registration.

- All your car keys and the owner’s manual.

- If you still have a loan on the car, you’ll need to have your account number or a payment stub.

- Maintenance records. These help support your claims about whatever prior damage your car has had and the repairs it has undergone.