3 Steps to Prepare Your Credit to Buy a Used Pickup Truck

If you’re looking to buy a used pickup truck, you’ve undoubtedly done your research in advance about the right model and options. The key to affording your dream ride works the same way: Get your financial situation under control before you make your final purchase decision.

If you’re looking to buy a used pickup truck, you’ve undoubtedly done your research in advance about the right model and options. The key to affording your dream ride works the same way: Get your financial situation under control before you make your final purchase decision.

Here are three crucial steps to take that will help you become more informed about your credit and help you set realistic expectations before you get to the dealership.

1. Know your credit score.

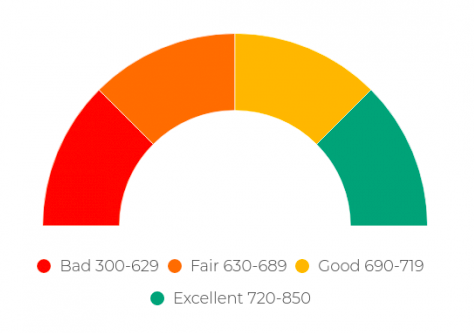

If you plan on using financing to buy a used pickup truck, your credit score is key to getting the lowest interest rates. Your credit score is a three-digit number that uses your credit information to assess how risky a borrower you are, and it can significantly influence how lenders decide the terms of your loan.

The higher your credit score, the lower your risk and the lower your interest rate. The lower your credit score, the riskier you are and the higher your interest rates. Be proactive in checking your credit score beforehand so you know where your credit stands before you apply for a loan.

Credit score ranges:

2. Get a free credit report.

When you check your credit score, be sure to focus on where you fall in comparison to other consumers, and what areas of your credit are strong — and what might need some work.

FTC (Federal Trade Commission) Website: You’re entitled to one free copy of your credit report every 12 months from each of the three nationwide credit reporting companies. Order online from annualcreditreport.com, the only authorized website for free credit reports, or call 1-877-322-8228. You will need to provide your name, address, social security number, and date of birth to verify your identity.

3. Take steps to clear any blemishes on your credit.

Everybody wants the best deal possible when they’re ready to buy a used pickup truck. Banks base their financing offers on how well you’ve paid your debts so it’s crucial to clear any negative items off your credit report.

FACTS:

- One in five Americans are shocked to learn there are errors on their credit report.

- 79% of consumers who disputed credit report errors were successful in removing them.

If you have any blemishes on your credit report, take steps now to resolve them.

Example: If you’ve got a $48 collection on your report, make every attempt to make it right. If it’s a mistake, call the company and try to rectify it with them first. If that doesn’t produce results, dispute it with the credit reporting agencies. All three – Equifax, Experian and TransUnion – have simple forms on their sites for disputes.

If the $48 collection is not a mistake, make every attempt to remedy it, including paying it. You’ll save much more than the $48 in finance charges that lenders will be forced to charge you if you leave it on your report.

Pro Tip: Our finance manager at Dye Autos says, “90% of the collections we see are due to medical charges/fees. Call the company and try to negotiate down the amount you owe and set up a doable payment plan so that things will begin to look more positive.”

Wrapping it all up…

Are you ready to buy a used pickup truck but need help preparing your credit? We have over 70 years experience in the car and truck financing business and we can help you! Call Dye Autos at (303) 286-1665 or fill out our handy contact form >>here<<.